Fascination About Custom Private Equity Asset Managers

(PE): investing in companies that are not openly traded. Roughly $11 (https://myanimelist.net/profile/cpequityamtx). There might be a couple of things you don't understand regarding the industry.

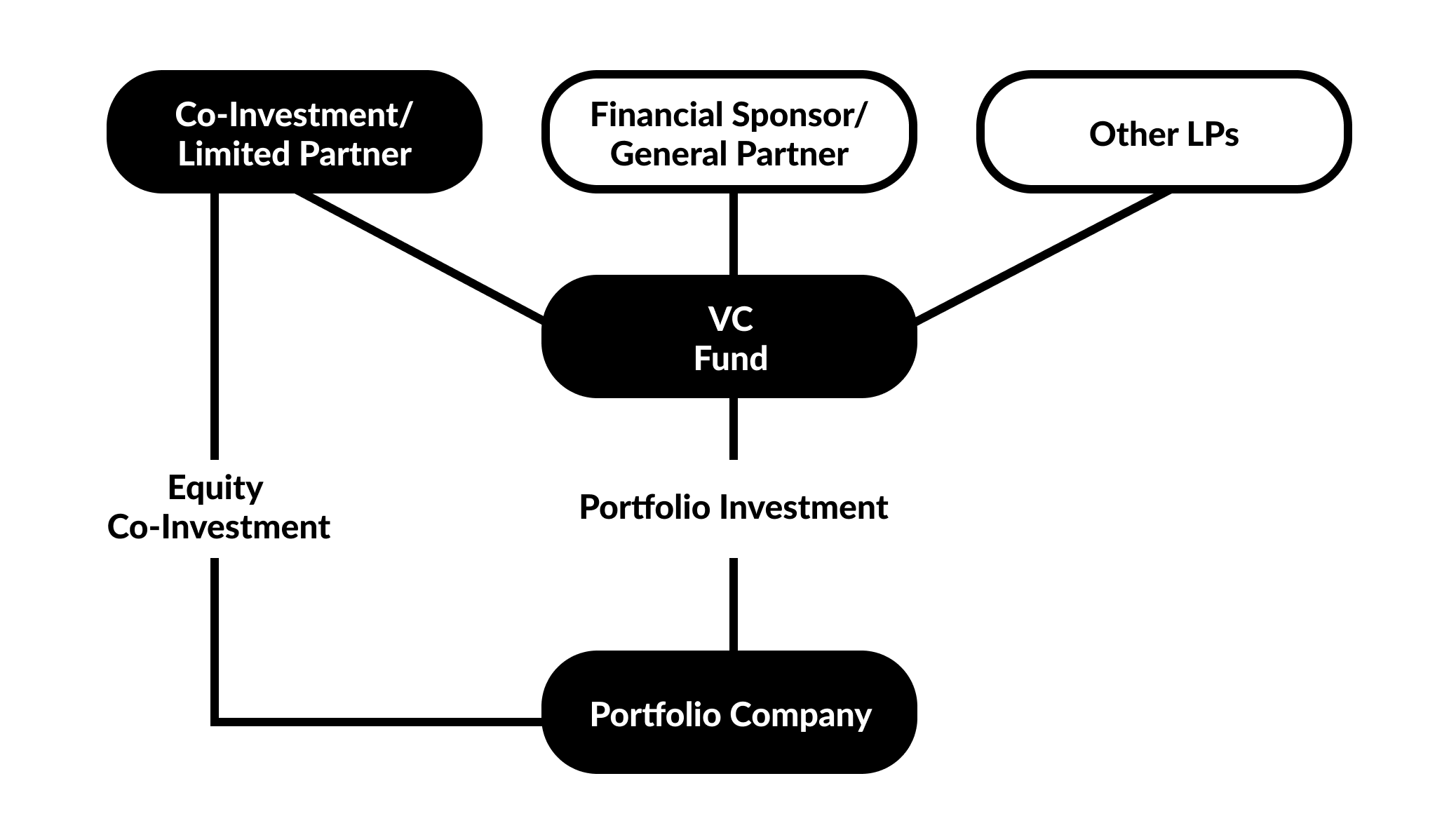

Partners at PE firms elevate funds and manage the cash to produce favorable returns for shareholders, usually with an financial investment perspective of between four and 7 years. Exclusive equity companies have a series of investment preferences. Some are rigorous sponsors or passive investors wholly based on management to expand the business and produce returns.

Because the most effective gravitate toward the larger offers, the center market is a dramatically underserved market. There are a lot more sellers than there are highly skilled and well-positioned money specialists with substantial purchaser networks and sources to take care of a deal. The returns of personal equity are normally seen after a couple of years.

5 Easy Facts About Custom Private Equity Asset Managers Described

Traveling below the radar of huge multinational firms, much of these little business usually provide higher-quality client service and/or niche product or services that are not being offered by the huge corporations (https://pubhtml5.com/homepage/mzmjd/). Such upsides attract the rate of interest of exclusive equity companies, as they possess the insights and savvy to exploit such chances and take the business to the following level

Private equity financiers have to have trusted, qualified, and trustworthy monitoring in position. Most managers at portfolio companies are offered equity and incentive compensation frameworks that award them for striking their economic targets. Such alignment of goals is typically called for prior to an offer gets done. Private equity opportunities are commonly out of reach for people who can not spend numerous dollars, yet they should not be.

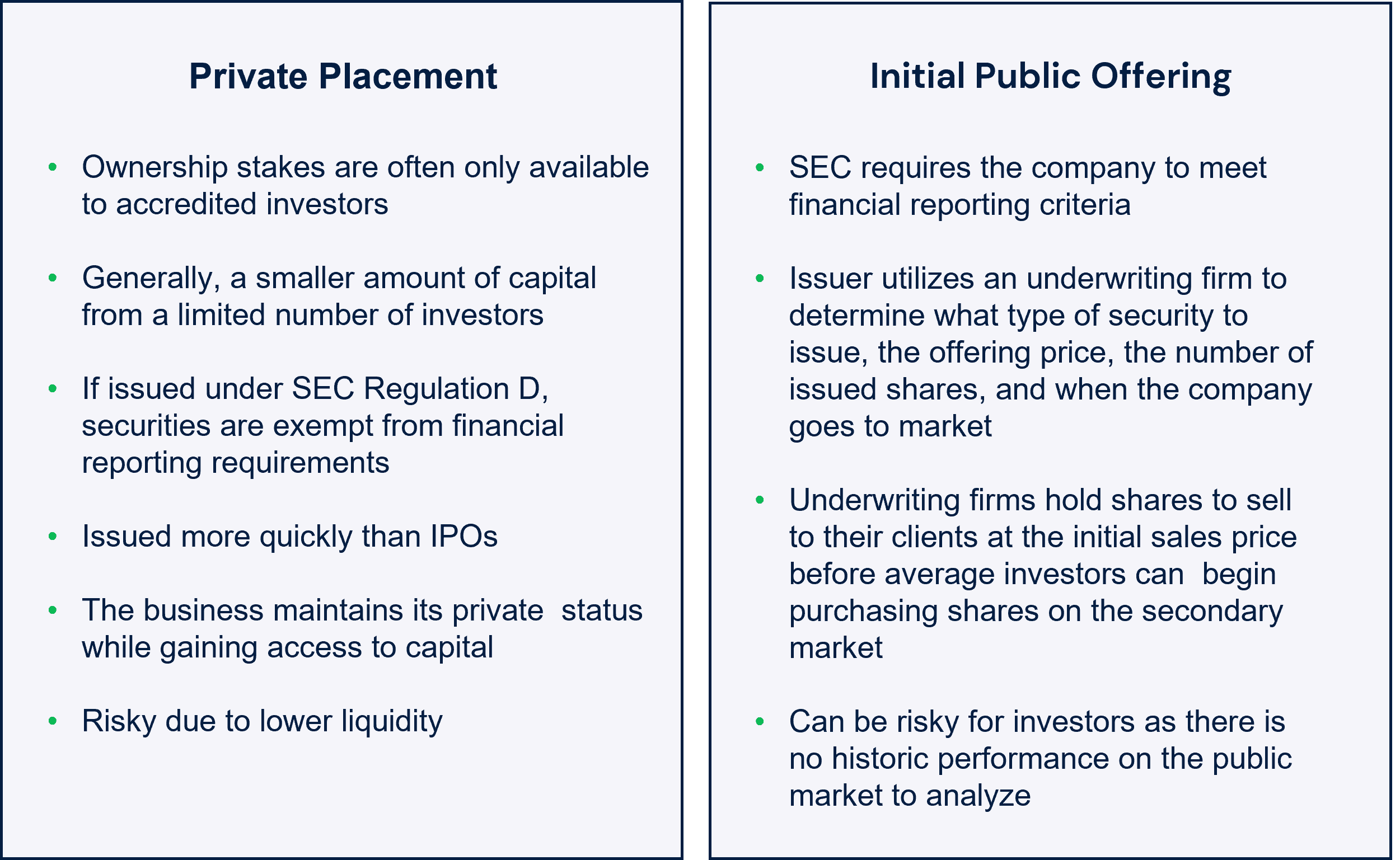

There are policies, such as restrictions on the aggregate amount of cash and on the number of non-accredited financiers. The personal equity business draws in several of the very best and brightest in corporate America, consisting of leading entertainers from Fortune 500 business and elite administration consulting firms. Law practice can additionally be recruiting grounds for private equity employs, as accounting and lawful use this link skills are required to total bargains, and purchases are very demanded. https://issuu.com/cpequityamtx.

Everything about Custom Private Equity Asset Managers

An additional downside is the lack of liquidity; when in a private equity transaction, it is not very easy to obtain out of or sell. With funds under administration currently in the trillions, private equity firms have become appealing financial investment cars for rich individuals and institutions.

For years, the qualities of exclusive equity have made the asset course an eye-catching recommendation for those that might participate. Since access to exclusive equity is opening approximately even more specific investors, the untapped potential is coming to be a reality. So the question to take into consideration is: why should you invest? We'll start with the primary disagreements for purchasing private equity: Exactly how and why exclusive equity returns have historically been greater than other possessions on a variety of degrees, How consisting of private equity in a profile affects the risk-return profile, by assisting to branch out against market and cyclical risk, Then, we will lay out some essential considerations and threats for personal equity investors.

When it pertains to presenting a new property into a portfolio, the most fundamental consideration is the risk-return profile of that property. Historically, exclusive equity has exhibited returns comparable to that of Emerging Market Equities and more than all various other typical property courses. Its relatively low volatility paired with its high returns creates a compelling risk-return account.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

As a matter of fact, personal equity fund quartiles have the best variety of returns throughout all alternate asset courses - as you can see listed below. Approach: Inner rate of return (IRR) spreads out calculated for funds within vintage years separately and after that balanced out. Mean IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund option is critical. At Moonfare, we accomplish a rigid option and due diligence procedure for all funds provided on the platform. The result of including exclusive equity right into a portfolio is - as constantly - based on the profile itself. Nevertheless, a Pantheon study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the very best exclusive equity firms have accessibility to an even bigger pool of unknown possibilities that do not face the exact same examination, along with the sources to do due persistance on them and identify which deserve purchasing (Private Investment Opportunities). Spending at the very beginning suggests greater risk, but for the firms that do succeed, the fund take advantage of higher returns

The Ultimate Guide To Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to spending a percent of the fund yet there remains a well-trodden issue with aligning interests for public equity fund administration: the 'principal-agent issue'. When a financier (the 'primary') employs a public fund manager to take control of their capital (as an 'agent') they entrust control to the manager while maintaining possession of the possessions.

In the instance of exclusive equity, the General Partner does not simply earn a management fee. They likewise gain a percentage of the fund's revenues in the kind of "carry" (normally 20%). This ensures that the interests of the supervisor are aligned with those of the capitalists. Personal equity funds also reduce another type of principal-agent trouble.

A public equity capitalist eventually wants one point - for the management to increase the supply cost and/or pay out returns. The investor has little to no control over the choice. We showed over the amount of private equity techniques - particularly bulk acquistions - take control of the running of the business, guaranteeing that the lasting value of the firm precedes, pressing up the roi over the life of the fund.